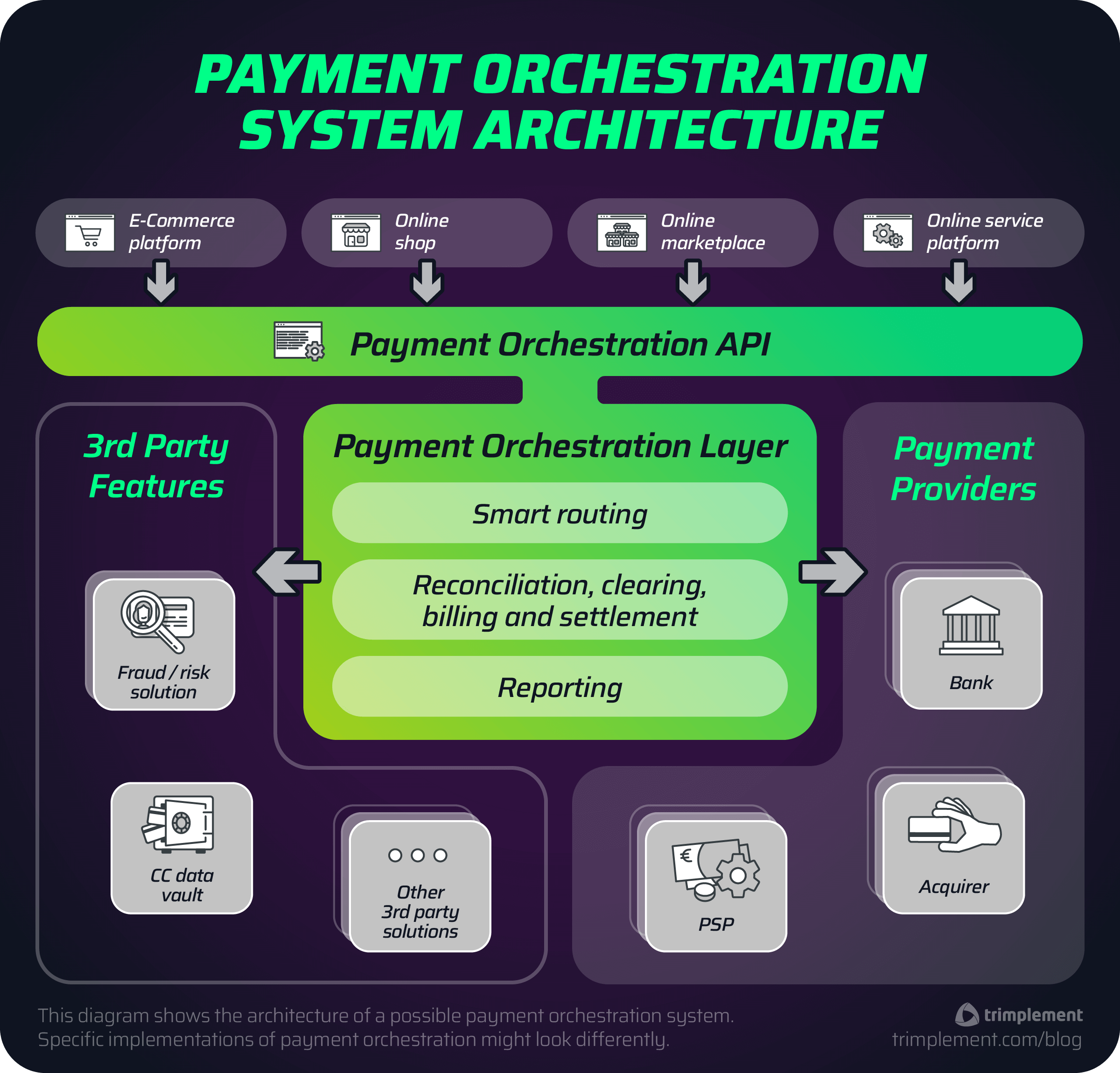

Payment Orchestration describes the mechanism of integrating and handling different payment service providers, acquirers and banks on a single, unified software layer. The Payment Orchestration software executes and manages the complete end-to-end payment process. That includes payment authentication, multi-PSP transaction routing, settlement, and much more. Also, Payment Orchestration encompasses processes such as risk management, secure customer data storing, Know-Your-Customer and Anti-Money-Laundering procedures, and the like.

A Payment Orchestration Layer (POL) – sometimes also called a Payment Orchestration Platform (POP) or a Payment Orchestrator – is the technological framework that manages user and merchant accounts, acquirers, payment providers, fraud detection services, etc., initiating, validating, routing and processing transactions involving those parties. In addition, a Payment Orchestration Layer handles payment processes such as reconciliation, billing and settlement, payouts and reporting.

A Payment Orchestration Layer (POL) is the entry point to and the heart of a payment system, streamlining payment automation. With POL, e-commerce platforms and online service providers don’t need to integrate every PSP and every acquirer separately. Instead, they can consume the unified API of the payment orchestration layer, benefiting from a reduced integration complexity. Moreover, a POL simplifies system maintenance and development for platform owners and merchants and streamlines interaction with third-party service providers.

So, In a Nutshell…

- Payment Orchestration consolidates all the key components for smart payment processing on a central software layer

- A provider-agnostic/vendor-agnostic Payment Orchestration layer streamlines the integration and management of multiple payment service providers

- Payment Orchestration optimizes payments by routing transactions along the optimal, reliable path

- Payment Orchestration enables offering of multiple payment options, while making a business independent from single payment providers, fraud prevention solutions etc.

What’s in it for Businesses?

Provider-agnostic Payment Orchestration comes with a number of advantages. These typically don’t occur in a single-PSP setup or solutions with the isolated integration of multiple PSPs, such as:

- Higher success rates in payment processing

- Improved flexibility due to an expanded payment stack of multiple different payment providers

- Automated payment routing based on certain criteria (consumer’s risk level, transaction costs, customer preference, etc.)

- Cross-provider token vaults for credit card data

- A common 3D secure engine across providers

- Unified data analytics and reporting, for improving and optimizing costs and processes

- And many more, see the section about benefits of a POL below

Sounds good? Well, one question remains!

Should you as an online retailer or service provider settle for Payment Orchestration as a general rule?

To help you find the right answer for you, this article will dive into various aspects of Payment Orchestration. It discusses:

- The state of Payment Orchestration in the current online economy

- The operational benefits of Payment Orchestration for businesses

- How a typical orchestrated payment process unfolds

- Next steps to set up Payment Orchestration

The State of Payment Orchestration Today

Payment Orchestration is a relatively recent term. It often describes what has formerly been called a Payment Gateway. Until a few years prior, it flew under the radar, even though it had effectively been implemented before. Even today, a unified definition of payment orchestration cannot be given within the fintech industry – for the remainder of this article, our definition from above applies.

Widespread adoption of Payment Orchestration has only been possible due to technological developments during the last decade. Larger e-commerce and BigTech companies have been at the forefront of adopting this approach. Early on, they built complex backend systems and unified APIs to be more agile and scale more rapidly.

But by now smart and powerful automation is accessible even for small and medium enterprises. Ready-to-use cloud infrastructures like AWS, GCP, or Azure remove the need for elaborate, company-owned server networks. In addition, payment service providers have improved, too, regarding the variety, flexibility, and quality of their APIs.

Projections suggest the global Payment Orchestration Platform market size will rise at a 24.7% CAGR until 2030, from a value of $US 1.13 billion in 2022.

– Source: Grand View Research, 2023

Why Payment Orchestration Is Complicated to Pull Off

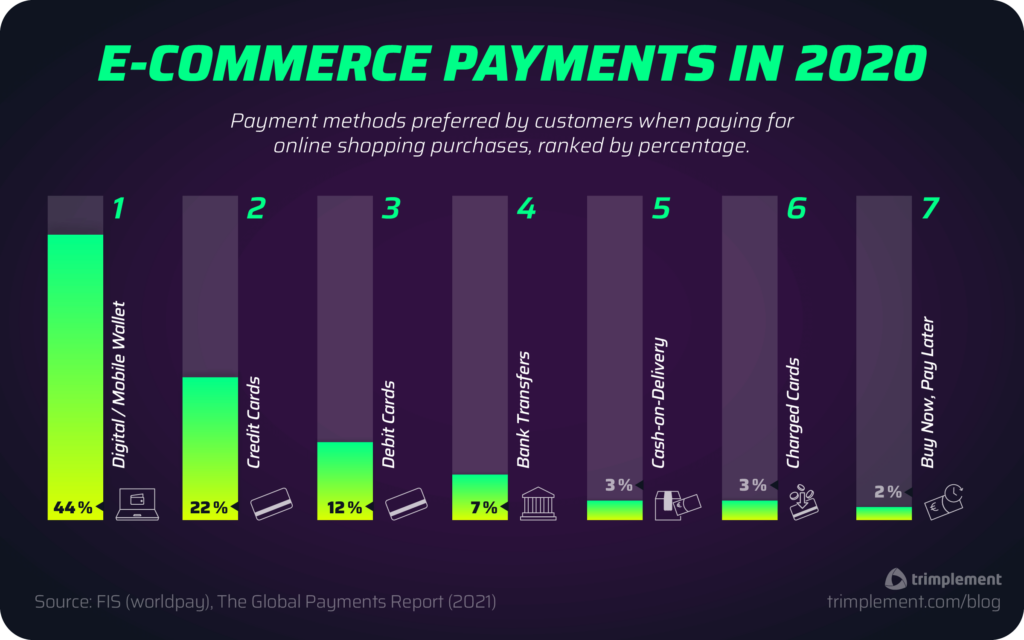

The number of digital payment transactions keeps climbing to new heights each year. And so does the competitive pressure to present your customers with a wide selection of PSPs and payment methods. In addition, you will be confronted with conflicting customer expectations:

- Some customers want payments to happen cross-border.

- Some want payments to happen locally with national, well-known payment providers.

- Some want payments to happen fast, in real-time.

- Some want payments not to happen right away: Buy Now, Pay Later is high on customer wishlists.

Meeting all of those expectations requires your global e-commerce or service platform to integrate a comprehensive set of different PSPs, banks, and acquirers. Add regulations such as PCI DSS, PSD2, and GDPR to the mix and you will end up with complex dependencies any legacy payment systems would likely struggle with. Payment Orchestration shows disruptive potential here; this central aggregation layer has to be designed with keeping all current compliance challenges in mind.

“If payments are the engine that is powering digital transformation, payment orchestration is how global enterprises can keep that engine running at peak performance.”

Source: Kristian Gjerding, CEO of CellPoint Digital, 2021

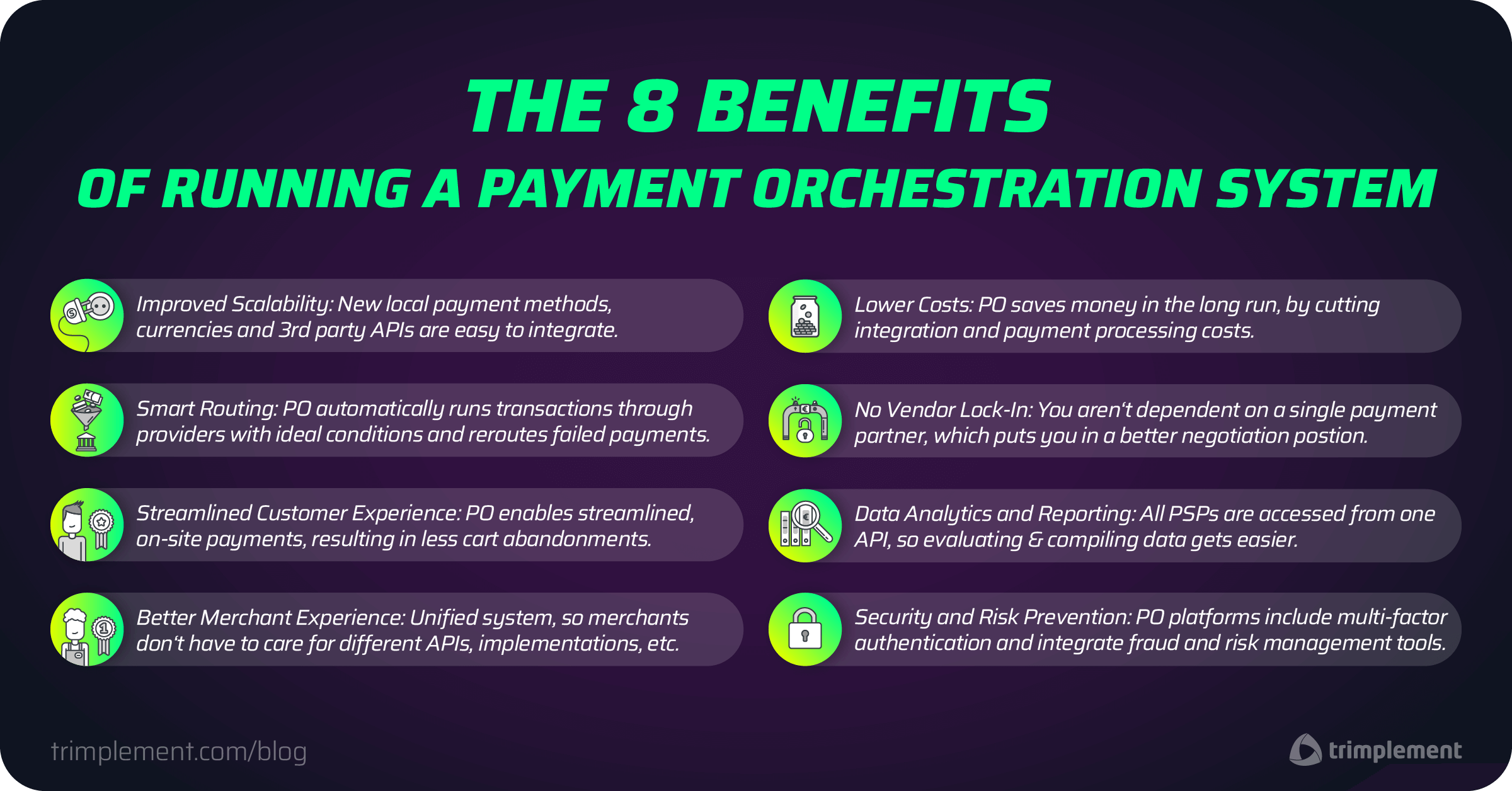

The Benefits of Payment Orchestration

Improved Business Scalability, Easier Integration

Expanding your services into new markets is typically a challenging task. Besides regulatory compliance, the integration of region-specific payment providers, local payment methods and currencies can be challenging. A Payment Orchestration Layer simplifies the process. It offers you a flexible, vendor-agnostic payment system architecture. This architecture unifies and simplifies the integration of third-party provider APIs, managing all PSP data within a single layer. Thus you can launch new payment options within a short timeframe and scale your business faster.

Smart, Dynamic Routing

transactions. You can set-up specific rules in your POP so that it will automatically choose the payment route with the best condition for every transaction, depending on several factors. It could mean

- Dynamically presenting customers only prefiltered available payment options (e.g. low-risk payment methods for high-risk customers)

- Choosing a channel with low transaction fees to reduce costs

- Processing the payment through a specific high-speed provider to reduce latency

- Automatically re-routing failed transactions to alternative acquirers / payment service providers to decrease failure rates

Thus, a Payment Orchestrator gives your business more control over how payments are processed. It increases payment acceptance rates, circumvents downtimes and outages and reduces checkout abandonment. Your merchants and customers will appreciate smart routing, too. They can be sure their transactions are fail-safe, fast and secure.

Streamlined Customer Experience

Studies show: Up to 50% of e-commerce customers abandoning their cart do it for reasons related to payment. Payment Orchestration Layer can prevent this by helping you harmonize your checkout flow. For example, you can easily set up an embedded checkout process, during which customers remain on your site or in your app, instead of being forwarded to external pages.

Additionally, you can give customers a broad choice of payment methods and providers (6% of customers quote the lack of payment options as a reason for abandoning their purchase). Thanks to the unified API of Payment Orchestration Layers, offering local payment methods on popular demand is very straightforward for e-commerce platform owners and merchants.

Better Merchant Experience

What’s true for consumers is also true for merchants. If you run an online marketplace, you can set up your Payment Orchestration Platform to cater to the specific needs of your merchants. POs offer a unified approach for triggering the payment, for payment splitting in mixed-cart purchases, reconciliation and also for refunds – one of the biggest challenges merchants face in e-commerce today.

Furthermore, merchants don’t have to handle distinct reconciliation file-formats that acquirers or PSPs present to them. They simply can trigger payments and refunds using the unified API of the POL. They don’t need to fumble with different APIs, implementations and processes. Lastly, the Payment Orchestration Layer can take care of merchant billing and settlement and automatically trigger payouts of available funds depending on individual configuration per merchant.

Lower Costs

Upon first gaze, traditional payment systems might seem cheaper to uphold. However, in the long term, Payment Orchestration Platforms will save you money.

Aside from preventing third party integration expenses from exploding, the modern infrastructure of payment orchestration platforms helps you improve operations and thus reduce costs. Add automated routing of transactions to least-cost payment providers and you get an idea of why Payment Orchestration is less expensive than conventional payment processing.

No Vendor Lock-In

Due to easy integration, Payment Orchestration Layers can incorporate a diverse range of PSPs and acquirers. This gives customers freedom of choice. And it also benefits you as a company: You are not dependent on a single payment partner, granting a safety net of alternative providers in case of payment outages, feature updates, or policy changes that don’t suit you.

Finally, having a choice puts you in a more favorable position when negotiating pricing with PSPs and acquirers.

Data Analytics and Reporting

Payment Orchestration Platforms greatly simplify payment data evaluation, due to their consolidating nature: All PSPs in a PO system are maintained at the same place. Compiling data reports for multiple PSPs in real-time is easily possible. This data can be readily shared as well, with merchants, fraud detection services, or financial authorities, for example.

For CEOs, Chief Payment Officers or Heads of E-commerce of international corporations, this intel also proves valuable for strategic decision-making. Payment Orchestrators will draw their data sets from payment providers operating across the globe. Comparing data points such as latency, success rate and performance at peak times, they can more easily identify which PSPs they want to go with in the future.

What’s more, businesses get valuable insights into customer behavior and payment flows. This grants them a competitive advantage, allowing them to personalize the customer experience and streamline back office processes, payment failure analysis, reconciliation and so on.

Security and Risk Prevention

A good Payment Orchestrator puts much emphasis on fraud monitoring and transaction security – just as international and national financial regulations demand. PO platforms commonly include multi-factor authentication and credit card data tokenization features right out-of-the-box.

What’s more, Payment Orchestration’s high capabilities of analyzing data also help improve transaction security. Payment reports are valuable resources for detecting potential security risks. In addition, fraud detection and risk management tools can be integrated to alleviate potential risks and guarantee secure transactions.

How an Orchestrated Payment Works

One of the most essential features of Payment Orchestration is finding the ideal digital route for a transaction to pass through. In many typical cases, the process will go down as follows:

- At checkout, customers select a payment method from available options, pre-filtered by the platform based on their country, risk score, and other criteria laid down in the Payment Orchestration system.

- The Payment Orchestration system will route the payment to the best suitable payment provider according to criteria like response times, transaction costs, acceptance rate etc.

- The payment is processed by the PSP or acquirer and may be approved or fail due to outages, errors, declines of authorization etc.

- If the payment fails, automatic routing fallback may kick in – the Payment Orchestration platform will re-route the payment then to an alternative gateway/acquirer.

- Once the payment is approved, the purchase is confirmed and completed.

- The clearing/reconciliation phase starts. The funds will be transferred between PSP/acquirers and the Payment Orchestration Platform.

Moreover, the Payment Orchestration Solution periodically runs billing and settlement processing and can automatically start payouts of the earned funds to its merchants. And finally, reports for different purposes can be automatically generated on a regular basis.

Getting Started with Payment Orchestration

The payment orchestration platform you integrate must fit your business strategy. There are plenty of factors that play into this decision: From budget to regulations to markets to software frameworks. So, before you commit yourself to a specific tech approach, it might make sense to bring in payment business consultation first, if strategic questions remain.

From a technical standpoint, there are two opposite ways to get Payment Orchestration up and running:

As-a-Service Payment Orchestration Layers

As Payment Orchestration is gaining traction in the platform economy, the choice of as-a-service Payment Orchestration solutions is broadening.

Companies like IXOPAY or GR4VY provide SaaS payment solutions that streamline transactions between platforms and payment providers. These third-party solutions usually support a range of partners (PSPs, acquirers, etc.). They also may have preset payment routing preferences. Pricing often involves pay-per-payment or pay-per-API-call rates, which can potentially increase costs over time.

Another downside to this approach is, that, while your company is not dependent on external PSPs, it is still dependent on the Payment Orchestrator and their vision on how to expand their PO product in the future. Depending on the solution, this can mean that the exact PSP you want to integrate might not be supported. And if you decide to sever your ties to a Payment Orchestration provider, it can be difficult to migrate your system to another one in due time.

In-House / On-Prem Payment Orchestration Layers

The main benefit of having an in-house / on-premise Payment Orchestration Layer that you have full control over your solution including

- The feature set, allowing to add differentiation features for more customer retention

- All payment flows handled within your system to provide a best-in-class experience

- Operational topics like security updates, cloud providers of your choosing and so on

- And – most importantly – the whole of the payment data processed in your system

Thus, on-premise Payment Orchestration Layer enables you to provide an optimal checkout experience and special features for your customers, giving you a competitive advantage over your rivals. You can also set up a payment analytics environment and gain valuable insights into customer behavior and possible payment bottlenecks in the system to continuously improve your offerings here.

One of the most fundamental decisions for a business would be whether to build or to buy an on-premise Payment Orchestration solution.

The Build Option

This approach is ideal for companies with a profound do-it-yourself attitude in place. Instead of relying on an external Payment Orchestration Layer, you build a payment system from scratch that can orchestrate transactions independently.

The flexibility of self-built solutions will work to your advantage. It’s your own product, so you can adjust it to meet your every need – and even apply it in your subsidiaries or license it to third parties. What’s more, maintenance and further development costs will reduce over time. All innovations are solely driven by your business vision.

The downside is that building a payment product from scratch takes time and money. In addition, you need an engineering team with comprehensive domain knowledge in payment software. Else, you run the risk of getting a low quality result – a tremendous risk in the business-critical environment of processing payments.

The Buy Option

Now, what if we told you that there is an easier option of establishing an in-house payment orchestration solution? An option which still caters to your specific business needs and grants you all the other advantages that come with running your own payment system?

It’s a solution that you simply license and seamlessly integrate in your existing environment to conduct payments right away. It comes with popular payment methods, supported right out of the box. While doing all that, it still remains very flexible and adaptable to your requirements. It runs on your infrastructure, so you have full control over the payment data. And while your business grows, you can easily expand and change it as you see fit, integrating any payment method and any third party solution or in-house system as you go along.

Sounds good? Well…

May we introduce…

Finergizer is a powerful all-in-one on-premise payment infrastructure that allows you to orchestrate payments and scale your business rapidly in new markets.

With Finergizer you get…

- A solution developed by payment experts with more than 10 years of experience in building payment products that are used in over 50 countries all around the world

- A provider-agnostic payment orchestration layer supporting popular payment service providers like Adyen and Stripe out-of-the-box but also letting you quickly integrate more

- A flexible microservice environment with stateless REST APIs, technology and cloud-agnostic

- An adaptable payment infrastructure with extension points, making it easy to integrate additional payment methods and third party providers

- A streamlined payment software, that routes payments following pre-set criteria and that remains stable during peak times, scalable by design

- And much more

Do you want to see all of this in action and learn how Payment Orchestration with Finergizer will benefit your business? Just try the software in our continually updated Finergizer DOCS demo environment!