Let’s spill the beans: You are in the e-commerce business for profit. Not solely for the profit perhaps. But it’s clear that you want to make money. And that means you must figure out how to get paid for the goods and services you offer online. The “how” is crucial: The choice of the Payment Service Provider you want to trust with processing your transactions with customers will resonate in every nook and cranny of your day-to-day operations. If payment doesn’t work, you won’t sell anything.

That’s true all the more if you are operating in multiple countries or across borders – preferences in Payment Service Providers (also called PSPs, Payment Solution Providers and sometimes Merchant Service Providers) fluctuate among nations and demographics.

Here’s the good thing: Whatever your business requires, there will be a Payment Service Provider with the right capabilities. That friendly online encyclopedia counts around 900 different Payment Service Providers worldwide, 300 of which cater to Europe and North America.

Now, you can see why the good thing is the bad thing at the same time. With so many options, how could you track down the best Payment Service Provider – the one that fits your business model and your market?

That’s the challenge this article is here to help you with. In the following paragraphs we will provide:

- A short definition of Payment Service Providers

- A compilation of decision points and criteria, which will help you determine what kind of payment your business needs

- A plan B to fall back on when none of the options offered by a single Payment Service Provider appeals to you.

Let’s see if we can narrow down your options.

Payment Service Providers: A Short Description

Payment Service Providers act as a facilitator for financial interactions between merchants or platforms, acquirers, card schemes etc. In this role, a Payment Service Provider can support various payment methods, such as direct debit, credit card, bank transfer, crypto payments or pay-by-phone-bill.

We should not confuse a Payment Service Provider with a Payment Gateway here. The latter operates as an orchestration layer. It enables businesses to integrate various different PSPs and may route transactions to one PSP or another, based on certain criteria. (If your company wants to set up a Payment Gateway, you can find more information here.)

There are other ways to facilitate payments, too – the most notable would be Merchant Acquirers for card payments.

Whether you want to rely on a single PSP or integrate multiple ones through a Payment Gateway layer, you should start the decision process right where you are: From the perspective of your business.

The Starting Point: Your Business

For the first part, generate an outline of your enterprise. Consider all the various elements that make up your core business. And while you do so: involve your product managers, CX experts, software engineers etc. in the process. They will help you identify necessities, challenges and blind spots regarding their fields.

In this way, you should answer the following questions, before you start looking actively for a PSP:

- What does your business offer? (products, services…)

- What do your target market and customer base look like? (demographics, income, etc.)

- What countries do you operate in and how do you prioritize them in terms of importance for your core business?

- What size is your business? How much do you expect it to grow within one year? (in customers, transactions etc.)

- What is your overall profit in a year? What is the cost-per-order you are willing to pay while still making a profit?

- What are the technical specifications and the features of your software? (online marketplace, service platform, mobile shop, etc.)

- What is your business strategy and timetable? Do you want to quickly release your platform or services and put up with higher initial PSP costs? Do you want to change PSPs later on, to a PSP with better conditions?

This list is not all-encompassing. Expand on it, if you can think of specifics that are missing here but prominently influence your business flows.

Your Goals

Once you have a good grasp of the technical, commercial and legal preconditions, you can define goals and prerequisites for Payment Solution Providers to fulfil. Ultimately, you will have identified:

- Critical features and technical requirements you absolutely need the PSP to have

- Nice-to-have features that would improve payments of your customers but are not necessary

- Deal-breakers and red lines that a PSP should not cross (incl. how much you want to spend on PSP charges)

With those goals in mind, you can go to a more detailed level and assess potential Payment Service Providers based on certain criteria, as presented below. Bounce them off your business requirements until you find the PSP that fits perfectly.

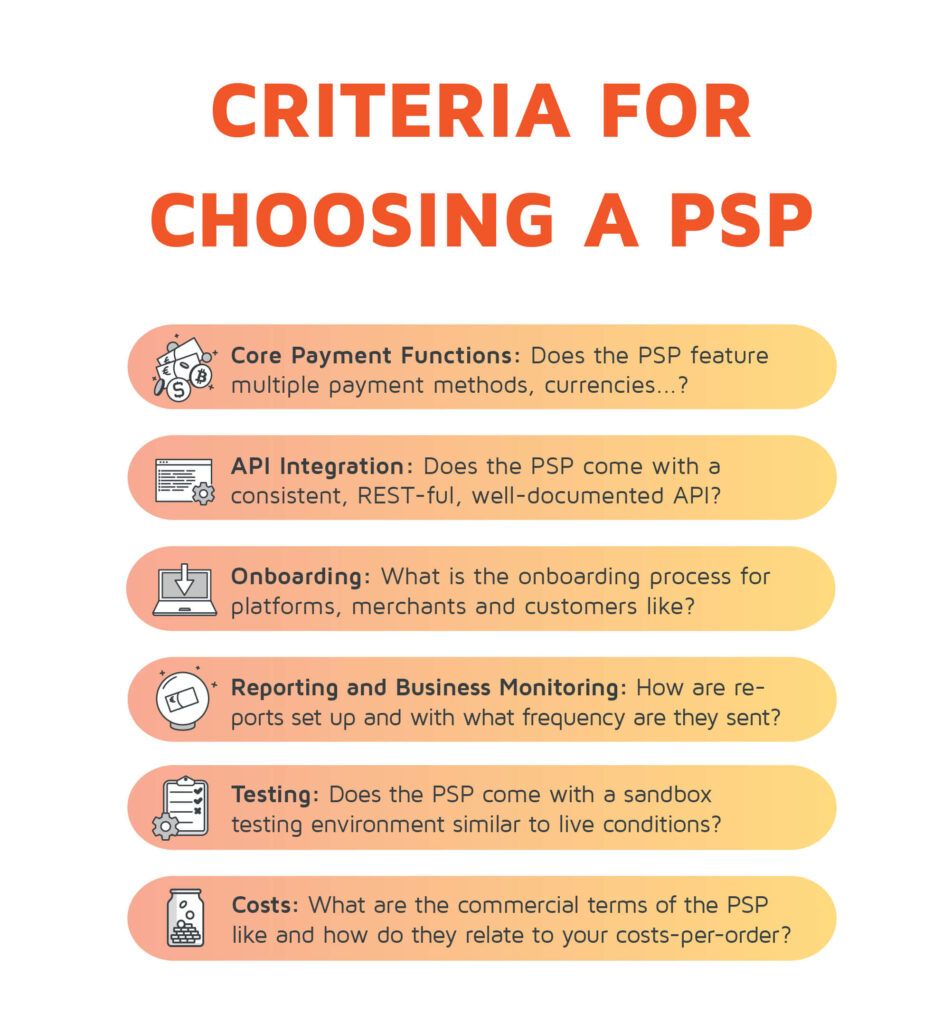

How to Find the Right Payment Service Provider: The Key Criteria

Individual PSPs differ widely in terms of costs, feature sets, APIs, UI integration etc.

To get an in-depth analysis of a certain PSP, establish direct contact with the provider: what’s written on their websites is presumably not all-encompassing. Instead, ask PSPs to provide you detailed information on their technology, reference customers, target groups, payment approval rates and so on – and let them back that up with data. Also, if the PSP has a demo environment, make sure to test it.

The following list presents reference points for when researching Payment Service Providers. If any of the topics are important for your business (certainly, several would), make sure to question a provider about their approach towards them.

Core Payment Functionalities of a Payment Service Provider

The capabilities of handling payment transactions take centre stage as a criterion for selecting PSPs. Or rather, as several criteria: Payment processes split up into a multitude of singular topics, all of which have an influence on a business’s commercial flow.

What Payment Methods Does the PSP Support?

Today’s customers expect a solid choice of different payment methods – in addition to what is already considered standard.

There are three payment methods that Payment Service Provider worth their name typically support:

- Direct Debit

- Bank Transfer

- Card Payments

On top of that, some PSPs can process more exotic payments like carrier-billing or crypto transactions or local specialities like Sofortüberweisung, iDEAL or Boleto Bancario, to name a few. Don’t shun the local ones: Supporting them often proves important when expanding into new national markets.

That said, you also don’t need your PSP to support every possible payment method on the market either. Instead, observe which payment methods are popular among your target demographics in the countries you operate in and make sure your Payment Service Provider supports them.

In the best case, settle for a Payment Service Provider with a history of adopting break-out payment methods ahead of the competition. That way you make sure to stay relevant on international markets. Offering the most popular and convenient Payment Methods can help you build a positive reputation and promote customer loyalty.

Does Your PSP Process Payments Instantly?

Faster transactions are better transactions – for you, for your customers and for your merchants. If you run a business that wants to offer real-time payments, make sure to choose a PSP that can ensure it. The payment approval rate at times, when many customers frequent the online platform, is a good indicator here. Furthermore, make sure that you close API Service-Level Agreements with Payment Service Providers, that detail the terms for API response times. No API calls should take longer than 5 seconds, as a rule of thumb.

Does the PSP Support Multi-Currency and Cross-Border Transactions?

If you are working globally, it’s always a good idea to offer customers the possibility to pay in local currencies. But that’s not possible without multi-currency support by PSP. In this case, be aware of currency conversion and the corresponding fees when choosing your PSP.

Finally, a PSP offering payments in a foreign currency does not necessarily entail permission to handle these transactions cross-border. Several countries – Russia, for example – legally require companies to only process customer data (including payment details) within their borders. Your PSP (and probably your business as well even) would need servers located in those countries to process payments and store customers’ data there.

Does the PSP Support Credit Card Tokenization?

Check a Payment Solution Provider’s credit card tokenization approach. The current standard is that PSPs generate PSP-specific PCI tokens, which are assigned to a credit card. For subsequent purchases with this payment instrument, only the token is needed instead of the full card details. So on the one hand, you don’t need to ask your buyers for their payment instrument data every time they make a purchase, which improves their user experience. And on the other hand, you don’t have to store clear-text credit card data, which would place you under the obligation to be PCI DSS compliant. Always bear in mind that changing the Credit Card PSP is a cumbersome process. It will require token migration if it is possible at all.

The other type of token is the network token or scheme token. Card Payment Schemes provision those tokens. They have the same purpose as PCI tokens: To be used in place of the full clear-text PAN during payments. However, they differ from PSP-specific PCI tokens, in that they are interoperable within the entire payment ecosystem, not only between the merchant and the PSP, and thus more secure. Many PSPs don’t have this kind of functionality yet. Nonetheless, you may want to support network tokens. They increase your authorisation rates, can qualify your payment transactions for lower interchange fees and help you to reduce risks. And that means you have to look carefully to find a PSP that can integrate with network token providers.

How Does the PSP Handle Failed Transactions and Chargebacks?

Top-Notch Payment Service Providers not only shine when transactions are successful. They also do, when something prevents transactions from happening.

Most PSPs have risk prevention strategies in place. They might even give a payment guarantee, compensating losses caused by failed payments. Some also rely on automation to keep approval rates high, for every declined transaction lowers the profits of merchants significantly.

For example, the auto-retry features of some Payment Service Providers use algorithms to determine whether a declined subscription renewal or charged-back payment has a chance to go through if tried again. Then the system repeats the payment process after a designated time period. Good retry algorithms can also help you to save unneeded transaction fees. Of course, that only works for specific types of payment problems.

Good Payment Service Providers credit card chargeback management can also save you trouble. Chargebacks can amount to a lot of work on the marketplace’s or merchant’s side, in case there is no accessible and well-documented merchant service UI in place. PSPs often send files listing requested chargebacks, which have to be authorized one by one. A convenient merchant service area helps you to stay on track with your chargebacks – especially important if you dispute one.

Those are just samples of important core payment functions of PSPs. Additional use cases exist, which certain Payment Service Providers might have solutions for. For instance, if you run a platform that offers subscriptions for products or services, you must make sure the PSP can process recurring payments.

Integration and API

Even the most powerful Payment Service Provider will be of no use when you can’t fit it into your existing software frameworks. To ensure easy integration, the PSP of your choice should feature a consistent, REST-ful API.

“Consistent” means “having a well-structured API” here. Select a PSP with an API, that abstracts from complexity and follows a clear lifecycle, refraining from unannounced changes. It’s important that the solution is flexible while standardizing international and regional payment method integration as much as possible: You don’t want to set up a new integration for every new payment method.

Aside from that, the API should be well documented, so that your software development team can find the information it needs. Mind the language barrier here: English documentation is a must. Having technical support for software-related questions at the Payment Service Provider will also prove useful. A full Software Development Kit (SDK) for use with the PSP is even better.

UI Integration

As a shop or marketplace, you would want to customize your checkout process – especially when catering to different channels like desktop and mobile, which should offer a unified user experience. You want to be compliant with PCI DSS, but might also prefer users to put in their card data on your page.

However, many PSPs work with redirects, passing on users to an external UI page, not in line with your brand. Some Payment Service Providers promise at least superficial customization options for the UI, but not all do.

Onboarding

Onboarding new clients is a day-to-day routine on payment platforms. So it better be as straightforward and efficient as possible – for you as a business as well as your merchants or subcontractors if you are offering a marketplace platform. Your customers will also not wait for your lengthy authentication process to be over: the easier the customer registration, the smoother the user experience.

If you accept merchants or other third-party service providers on your marketplace platforms, avoiding manual steps in merchant onboarding with the PSP is even more important. You don’t want to have to establish a genuine onboarding department just to deal with the requests, do you?

And, lest we forget: Consider your business’s own onboarding processes, too. Ask for a PSP’s timeline of how long onboarding to their system will eventually take and what the process looks like.

Compliance and Risk Management

All PSPs that even come into question absolutely must adhere to level 1 PCI DSS compliance standards if they process, transmit or store non-encrypted cardholder data. That’s the highest level of PCI DSS compliance, involving regular on-site audits by Qualified Security Assessors (QSAs) or Internal Security Assessors (ISAs). It ensures that your customers’ payment data are protected in the best way possible. Any merchants you onboard to a PCI DSS level 1 compliant PSP will have to comply with a lower level of the PCI DSS requirement (e.g SAQ-A / SAQ-EP), until they reach a certain threshold in transactions. That threshold increases the PCI DSS level for the merchant to Level 1. Fulfilling the requirements remains easier for the merchant, however, if cardholder data processing and storage remains with the PSP.

Moreover, make sure your provider of choice can fulfil all KYC, AML and CTF requirements of the regions you operate in. (If you need more information on Know Your Customer Processes demanded by financial service platforms: We have an overview for you here.)

Aside from the basics, it’s also advisable to have a good understanding of the anti-fraud management systems the PSP harnesses: What do their fraud auditing, fraud prevention and fraud detection look like?

In the same vein, different PSPs assume different grades of liability in case of losses or incorrectly executed transactions – make sure to have a good understanding of them as well.

Uptime

A factor of reliability that deserves special attention is a Payment Service Provider’s uptime ratio. It’s a number that indicates how constantly a PSP remains available for operation. PSPs with a low number will have frequent problems with transaction time-outs and platform breakdown. The standard for proper PSPs lies between 99,95% and 99,99% uptime, but not all small or local Payment Service Providers can guarantee that at all times. Make sure to choose a provider who can keep uptime high wherever possible.

Reporting and Business Monitoring

You must keep track of transactions happening within your system, from the initial payment request to the settlement report. Payment Service Providers show differing capabilities in this regard.

It starts with the question of timing: How often are transaction reports handed out by the system? Monthly, daily – and do you have options to change those intervals?

Much more important than the frequency is the form the reports take, however. It’s not a given that a PSP provides a clean overview of all expected information. Take a look at the decline messages, for example, and how detailed they are. If your business’s payment portfolio includes multiple acquirers and payment methods, give preference to PSPs that send out neatly arranged all-in-one settlement reports. Don’t take on the work of paying employees to puzzle different payment reports together if you can avoid it.

Your best indicator for whether a Payment Service Provider will ultimately create a surplus workload for you is its Merchant UI. Your PSP should present you with a well-composed dashboard with diagrams, balances, payment and customer data. Additionally, it should enable you to download different kinds of reports, whenever you need them.

It makes sense to give those Merchant UI and reporting features a test run during demo sessions. As we’re talking about it…

Testing

The Payment Service Provider making the cut should come with an extensive sandbox test environment. You cannot go live with a theoretically working but untested payment system. The sandbox environment of the ideal PSP is very closely matched to a live environment – mock testing is not nearly as effective. But even the best system will not do much good if it produces imprecise test reports. Make sure the system is well-documented… and documents well.

Costs and Efforts

When it comes to budget questions, go with PSPs that are upfront about their conditions and don’t try to sneak in hidden costs. When you use a Payment Service Provider, you will have to pay different fees. They could be either a fixed rate, most often a percentage of the transaction, or varies, related to minimum and maximum transaction thresholds, expected revenue and so on. Also, currency conversion fees can come into play. Some PSPs even charge extra fees for microtransactions or small transactions. Alternatively, they might demand a one-time setup fee at the beginning of the business relationship with you.

You see, commercial terms can get complicated, so make sure to not miss out on anything here. As a rule of thumb: The longer you stay with a PSP, the lower the costs listed in the contract will probably be.

Alternative Paths: Building your Own?

With a few hundred Payment Service Providers on the market, there will be at least one that might suit your needs.

But what if you don’t want to rely just on a single third-party solution? In this case, you could take into account building your own payment gateway to integrate more than one PSP to be more flexible. We discuss this option elsewhere.

Conclusion

Choosing a Payment Service Provider is one of the most consequential decisions you have to make for your business. Don’t rush yourself and consider all options.

Remember to make a clear outline of what your company needs in a Payment Service Provider, considering and prioritizing those factors:

- Core Payment Functionalities (Payment Methods, Multi-currency Support, Failed Transactions and Chargebacks, Instant Payments)

- Integration (REST-ful API, Good API documentation, UI integration options)

- Onboarding (Customer, Merchant, Initial Setup)

- Security and Risk Management (PCI DSS Compliance, Compliance with AML, KYC, CTF, Fraud and Risk Prevention)

- Reliability (Uptime, Regular Updates)

- Reporting and Business Monitoring (Report Frequency, Report Content, Merchant UI)

- Testing (Sandbox Environment, Support)

- Costs (Fees, Commercial Terms, Hidden Costs)

If you can put a checkmark behind each one of these items, you have found the Best Payment Service Provider candidate to entrust your payment processing with.